Family Finance: Say 'Yes' to 8 Steps That Will Set Your Marriage Ahead

Many premarital counselors have an entire section of their counseling plan dedicated to talking about finances. Why? Because financial differences of opinion, as well as behaviors, are a leading cause of marital strife! If you aren't married yet, now is the perfect time to assess. Before the big day, sit down with your partner and talk through these family finance steps you'll want to get started on.

1. Leave No Stone Unturned

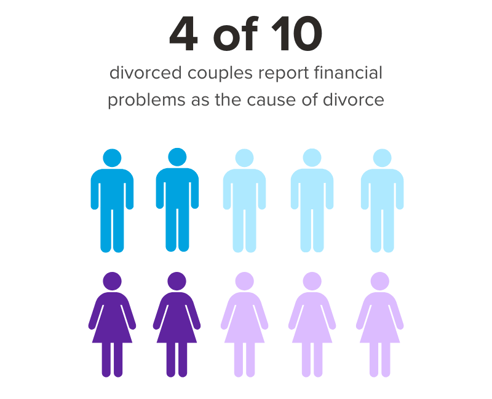

It's no secret that many marriages end with divorce here in the U.S. But did you know that 38% of divorced couples report that financial issues are what caused the divorce?1

Money problems put additional strain on other areas of the relationship, so it's a good idea for both of you to lay your entire financial story on the table (if you haven't already). The clearer you are about where you stand with your family finances, the better off you will be in the long-term.

A great way to quickly show your financial standings as a couple is to complete a simple net worth calculation.

This involves totaling all assets, like positive balances in all checking and savings accounts, including retirement, as well as the value of the things you own, like your home and car. Then, you list outstanding debts like student loans, credit card debt and any payments owed to previous spouses (such as child support). Subtract your debts from your assets and you've got your net worth. Use this momentum to put together your financial goals and your budget plan.

Tip: If you have a mortgage or auto loan, simply take the current value of the asset and subtract the outstanding balance on the loan. The difference is your net worth.

2. Talk Family Finance

As we grow up in different households, we develop our own established roots and beliefs when it comes to saving, spending, and investing hard-earned money.

Take the time to discover what money means to you and your partner. Does money give you a sense of security? Power? Or maybe flexibility, splurging, and giving back to those in need.

Money isn't one-size-fits all. That's why talking about and finding your financial truth as a couple is extremely beneficial. You can set clear expectations, reduce arguing, and get closer to your ideal family finances.

3. Bank as a Married Couple 🤝

Not all couples will have joint bank accounts exclusively... but, there are some benefits to having at least one or two. Managing family finances and household expenses can be much easier with accounts that both partners can access and contribute to.

- A joint checking account can be used to pay for shared expenses like the utilities, groceries and housing payments.

- A joint savings account is perfect to save together for big purchases like vacations, new furniture, home improvement projects, and other fun couple-y things.

- Joint loans also helps the partner with lower credit to build more quickly and efficiently.

Shameless Plug: We love setting couples up with joint accounts ❤️ Our branches are happy to help you and your partner find great services that are right for you.

4. Create a Budget Together

Even if you have separate accounts, using a free budgeting template and creating a joint household budget is essential to reaching your family finance goals (and maintaining peace)!

Talk with your partner about your perspectives on setting up a savings plan, how to track spending, and generally what financial health means to you. Even something like taking a vacation on a budget should be discussed with your partner. When you prioritize your joint financial goals in setting up your annual and monthly budgets, everyone will be happier. 🙏

Budgeting is a great habit to get into, especially when you have significant expenses to consider such as planning a wedding or having children.

5. Controversial: Get a Prenup

If you and your partner are coming into marriage with considerable amounts of assets or debts on either side, it's a good idea to think about a prenuptial agreement.

In short, a prenup is a legally binding contract stating how spouses will divide debts and assets in the event of divorce.2 It allows you and your spouse to plan and address common legal hurdles that come up during divorce (ultimately, to avoid many other financial dilemmas).

With a prenup, you can:

- Protect your personal property and family heirlooms

- Decide how to split any assets you will acquire as a couple

- Protect yourself from taking on your spouse's separate debt

It's not for everyone, but it can save time, money, and headaches down the road for those who do need it.

6. Change Name(s)

If one or both partners choose to change their name, it will be important to take steps to ensure your creditors, financial institutions, and other entities are aware of the name change. This process can take time, so don’t delay. It may be helpful to make a list of all places and documents that may require official name change information, such as:

- Social Security card

- Driver's license

- Passport

- Vehicle registration, lease agreements and other documents

- Schools

- Workplaces

- Creditors (including any outstanding student loans)

- Financial institutions

- Voter registration

Generally, you'll have to start with a social security card change, then move on to the driver's license. After that, those two documents will help you to make edits on everything else.

7. Modify Insurance Policies

Insurance policies often have limits as to when you can make changes after a qualifying event like marriage. You typically have 30 days, but sometimes as little as two weeks. Make sure you go over your options beforehand, so you know which changes to make. ✍️

Bundle and Save

While you will probably be combining things like homeowner’s or renter’s insurance naturally, another area to consider is auto insurance. Will it save you money to combine policies? It's true that many companies offer multi-car discounts that can support your family finance plan.

Health Insurance

- Is it less expensive for one partner to move onto the other’s health insurance?

- Are there any children that now need health coverage?

- Which insurance plan has better coverage or which saves money for other goals?

- Does one insurance plan have better parental leave coverage, in the event you wish to add children to your family?

Life Insurance

If you and your spouse do not currently have life insurance policies, now is a great time to get them—especially if you have children! Remember, life insurance is less expensive for you today than it will be tomorrow. The cost of it increases as you age and add health conditions to your resume.

If you already have life insurance, make sure to update your beneficiary to your new spouse. A good place to start is to have enough life insurance to pay off all of your debt, plus one year's salary - per person. If you have kids or are planning on it, you may want to go higher than that.

8. Make a Will

No one wants to think about it... but in the case of death of one or both partners, it is so important to have a will set up. Again, having children makes this even more vital!

Putting a will in place will make things much easier if the worst happens. With a will, you can:

- Select people to inherit your property and assets. Usually by state law, your assets will automatically go to immediate family unless you declare otherwise in a will.

- Choose a guardian for children and a trusted individual to manage what you leave to children

- Name a personal representative to ensure the terms of your will are carried out after your death

For some, you can take care of this on your own with some simple online software. However, for many who have more complicated estates, you'll want to meet with a professional for this family finance item.

The Credit Union Financial Network Wills & Trusts Document Preparation team offers complimentary, no-obligation assessments.3 You can give them a call at (888) 656-4415 or email them at willsandtrusts@cufn.org to find out more.

Wedded bliss will be even more sweet once you've set up your family finance support system and can enjoy peace of mind. On to bigger and better things! Oh, and congratulations. 😘

Can't get enough family finance? We've got more 👇

❌ Avoid 1 Thing When Talking Money With Your Partner

✔️ Ways to Start Quality Money Conversations With Kids

🍍 Fire Up Your Savings Game at the Grocery Store

Sources

1 Forbes https://www.forbes.com/advisor/legal/divorce/divorce-statistics/

2 Nolo https://www.nolo.com/legal-encyclopedia/prenuptial-agreement-benefits-drawbacks-29909.html

3 CUFN Wills & Trusts Document Preparation is a legal document preparation business entity, License #81937, certified through the Arizona Supreme Court. CUFN and its employees are not attorneys and cannot provide legal advice. For Arizona residents only.

Certified Legal Document Preparation Services are not insured by the NCUA and have No Credit Union guarantee.

This article is intended to be a general resource only and is not intended to be nor does it constitute legal advice. Any recommendations are based on opinion only. Rates, terms and conditions are subject to change and may vary based on creditworthiness, qualifications, and collateral conditions. All loans subject to approval.