Know your

tax bracket.

Check 2023 deadlines.

See the

standard deduction.

Cathryne, Employee

This guide was so helpful in preparing my taxes. Everything you need to know is all in once place!

Table of Contents

-

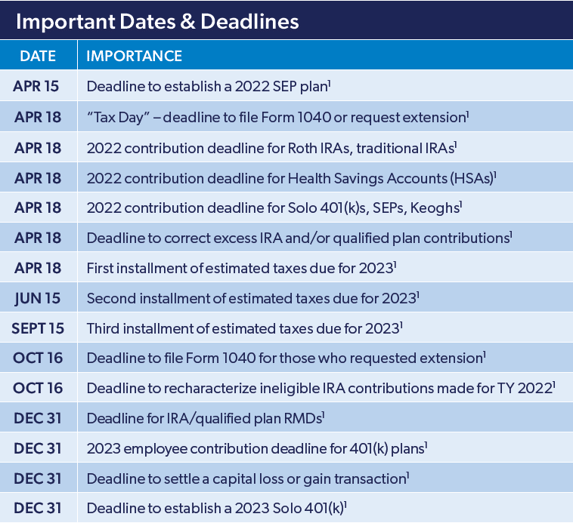

Important Dates and Deadlines for 2023

-

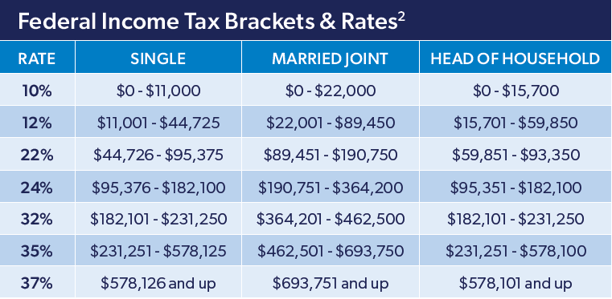

Federal Income Tax Brackets and Rates

-

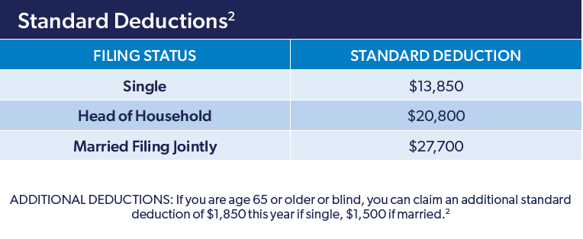

Standard Deductions

-

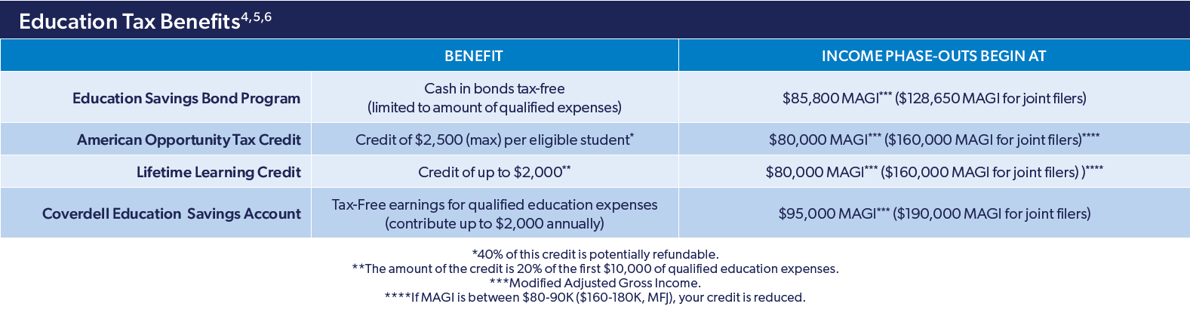

Education Tax Benefits

-

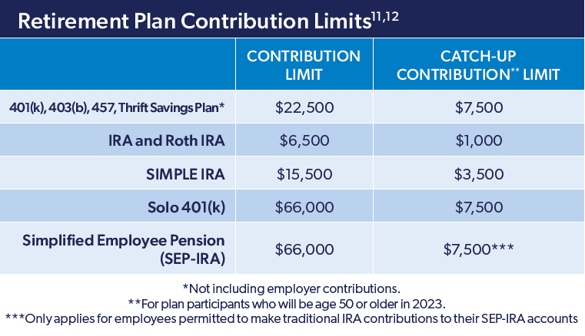

Retirement Plan Contribution Limits

-

Also included in the free PDF:

- Alternative Minimum Tax Exemptions

- Qualified Dividends and Long Term Capital Gains

- Net Investment Income Tax (NIIT)

- AGI Limits and IRA Contribution Deductions

- Estate and Gift Tax Rates, Exclusions, & Exemptions

- Medicare Costs, Deductibles & Coinsurance

- Health Savings Accounts, High Deductible Health Plans

- Social Security and Taxable Benefits

- Extended Care Coverage Deductibility Limits

2023 Tax Brackets and Deadlines to Know: Quick Reference Guide

This two-page PDF download will share all the numbers, dates and other things you need to know to be prepared for the rest of the year. We'll share some of the graphics below and the rest will be located on the PDF, once you download it.

In the retirement and investment world, there are a lot of moving variables. We're here to help! We have resources for you such as on-demand articles, calculators and coaches. Here are a few of our favorites:

- Your Tax Return Pre Game

- Retirement Checklist

- Do I Have Enough for Retirement?

- 4 Really Good Reasons to Invest

- 5 Often Overlooked Tax Deductions

Important Dates and Deadlines for 2023

Federal Income Tax Brackets and Federal Income Tax Rates

2023 Standard Deductions

Education Tax Benefits

Retirement Plan Contribution Limits

More Opportunities to Grow:

- Take Advantage of Arizona's 4 Most Popular Tax Credits

- Alternative Investments to Look At

- How Prepared Are You to Retire?

- Look Ahead and Check 2024 Tax Brackets and Deadlines

-1.png?width=300&name=300x400%20ebook%20cover%20(2)-1.png)

Investment advisory services offered through PFG Advisors, LLC, a SEC registered investment adviser. Securities offered through Osaic Wealth, Inc., member FINRA/SIPC. Insurance products offered through approved carriers. Copper State Credit Union, PFG Advisors, LLC, and Osaic Wealth, Inc. are separately owned entities and are not affiliated companies.

Not FDIC/NCUA insured | No Financial Institution Guarantee | May Lose Value

This material was prepared by FMG Suite, and the information given has been derived from sources believed to be accurate. This is not intended as a guide for the preparation of tax returns, nor should it be construed as legal, accounting or tax advice. This information is subject to legislative changes and is offered “as is”, without warranty of any kind. Publisher and provider assume no obligation to inform readers of any changes in tax laws or other factors that could affect the information contained herein.